PUBLIC NOTICE

SALE OF VALUABLE REAL PROPERTY

BY DECREE OF THE CHANCERY COURT OF ANDERSON COUNTY, TENNESSEE

FIRST AND FINAL PUBLICATION, PURSUANT TO TENN. CODE ANN. § 67-5-2502

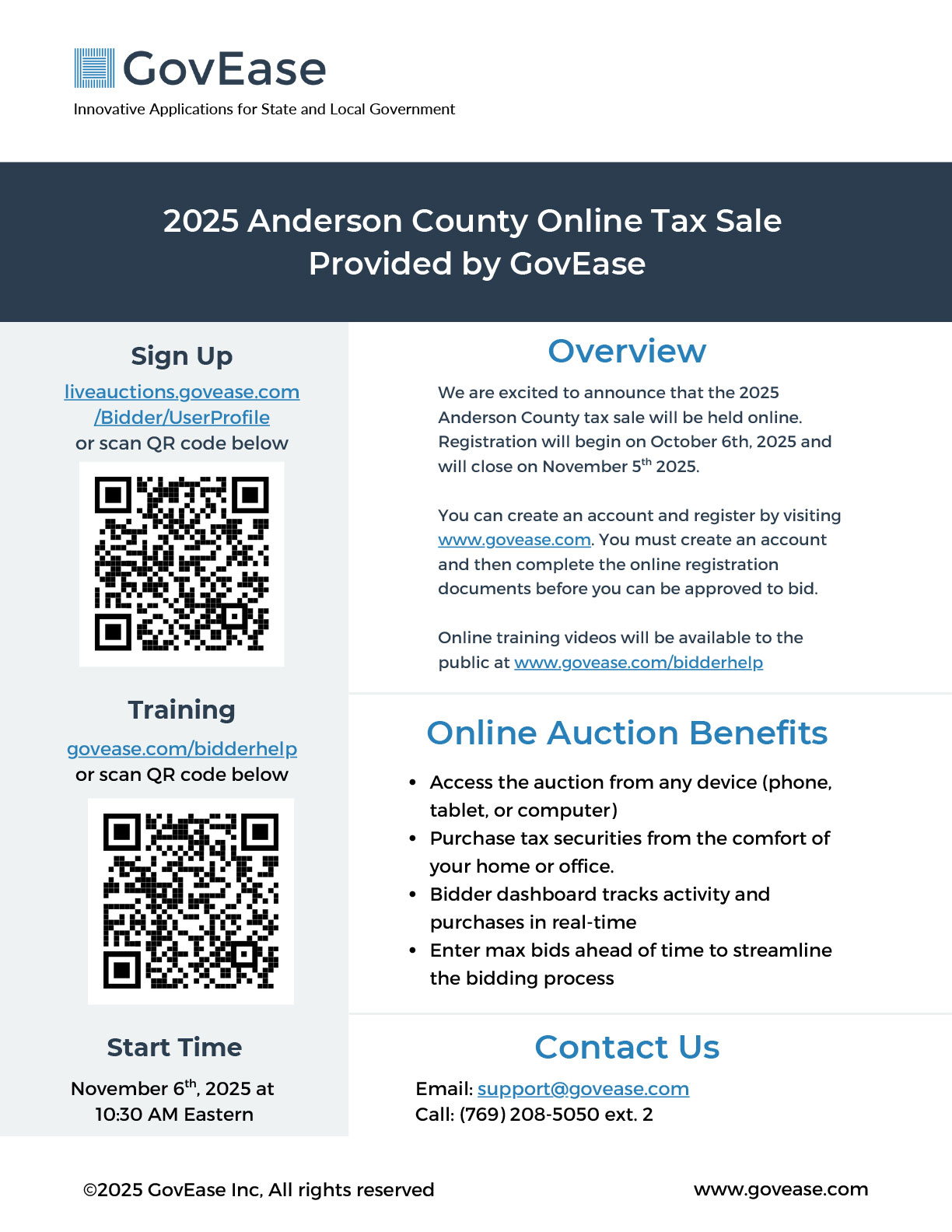

DATE OF SALE: Thursday, November 6, 2025

TIME OF SALE: 10:30 a.m., EST

PLACE OF SALE: Internet Auction www.govease.com

MANNER OF SALE: This is an online auction.

Pre-registration through www.govease.com is REQUIRED.

NOTICE AND REASON FOR SALE: Delinquent taxes owed to Anderson County, Tennessee, in the cases of STATE OF TENNESSEE ex rel, ANDERSON COUNTY v. Delinquent Taxpayers as shown on the 2019 and 2020 Real Property Delinquent Tax Records of Anderson County, Tennessee, Defendants, No. 21CH3016 and No. 22CH3980 (and consolidated cases for tax years 2014, 2015, 2016, and 2017, Nos. 16CH8009, 17CH8780, 18CH192, and 19CH1070).

By virtue of the order for sale entered in the above styled cases on June 6, 2025, as amended by the order for sale entered on July 28, 2025, the Clerk and Master will sell electronically in lieu of public outcry BY INTERNET AUCTION to the highest bidder, for cash (as defined below) on Thursday, November 6, 2025, at 10:30 a.m., EST, to satisfy liens of unpaid Anderson County taxes, properties situated in Anderson County, Tennessee, described on Exhibit A, below. Purchasers at the tax sale are advised to investigate the referenced deed for the size and location of the parcel that they wish to bid on, and to also investigate the title to such property. No warranties whatsoever of any kind will be conveyed to the successful bidder. Listed with the description of each parcel is the sum total of Anderson County taxes for which said sale shall be made, said total being inclusive of interest, penalties, attorney fees, and costs through the year 2020.

TERMS OF SALE: All payments will be made directly to Govease Auction. Payment types accepted are: ACH/E-CHECKS AND WIRE TRANSFERS. Subject to the Equity of Redemption of one year, and subject to tax liens of any municipality for unpaid taxes. Each parcel of property together with the names of the owners, the base amount of County taxes hereinafter listed and tabulated, are set forth on Exhibit A, below. The judgment amount shown on Exhibit A, below, is subject to additional interest, penalties, and costs.

FOR FURTHER INFORMATION, go to www.govease.com for preregistration requirements and tutorials for electronic bidding. Also, additional information may be obtained by visiting andersoncountyclerkandmaster.com and then click on “Delinquent Taxes”.

ISSUED BY: Harold P. Cousins, Jr., Clerk and Master

DELINQUENT TAX ATTORNEYS: Philip R. Crye, Jr., 125 N. Main Street, Clinton, TN 37716

(865) 457-9291 (tax years 2019 and 2020), and Doyle Thornton Teno, III, 325 Maple Street, Clinton, TN 37716 (tax years 2014, 2015, 2016, and 2017)